Venmo

Venmo Review

Venmo is a popular digital wallet and peer-to-peer (P2P) payment app that has rapidly become a household name for its convenience in allowing friends and family to split bills, share expenses, and send money with just a few taps on their smartphones. It's designed for users who want a quick and simple way to manage their transactions without the hassle of cash or checks.

What are the purposes of using the Venmo

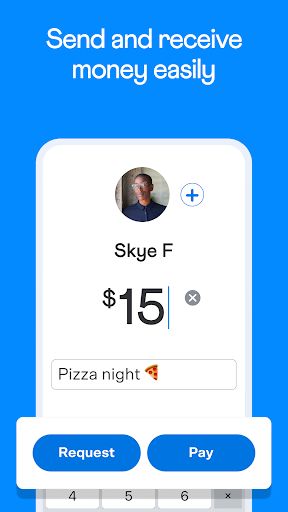

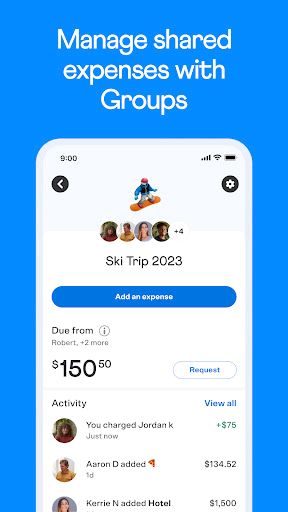

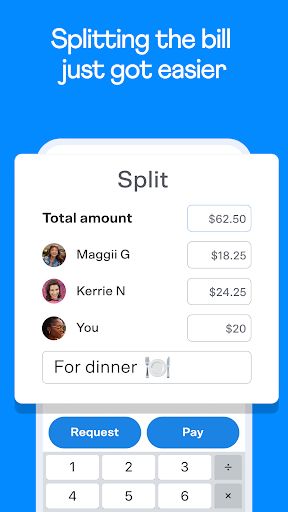

Venmo serves multiple purposes. It's primarily used for sending and receiving money between friends, which can include everything from splitting a restaurant bill, paying rent to a roommate, or sending a birthday gift. Additionally, Venmo can be used for purchasing goods and services from merchants that accept Venmo payments. The app also incorporates a social feed, where users can share their transactions with friends, complete with emojis and messages.

What does the Venmo app provide?

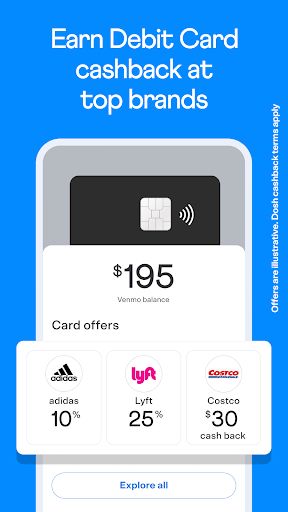

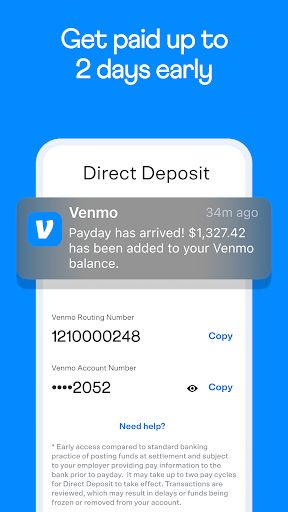

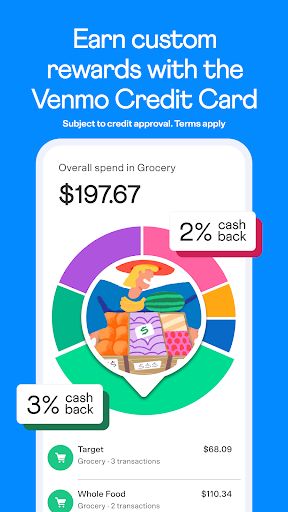

The Venmo app provides a user-friendly platform for financial transactions among peers. It includes features such as the ability to link bank accounts, debit cards, and credit cards to fund transfers, request money from others, and make payments. Security is also a key aspect of Venmo, with the app offering several layers of protection to keep users' financial information safe. Additionally, the social component of Venmo distinguishes it from other payment apps by allowing users to interact and engage with each other's transactions.

Benefits & Features

- Quick and easy money transfers between friends and family.

- Social sharing of transactions with personalized messages and emojis.

- Option to link multiple funding sources, including bank accounts and cards.

- Enhanced security with encryption and optional PIN codes.

- Ability to pay participating merchants directly with the app.

- Real-time notifications of transactions and account activity.

- Option to cash out funds to your bank account.

- Accessible through both mobile app and desktop versions.

As an accessible and socially integrated payment platform, Venmo has effectively reshaped how many people handle small, everyday transactions. Its blend of convenience, speed, and a touch of fun with its social features makes it a standout choice for anyone looking to simplify the way they share expenses and send money.

Pros

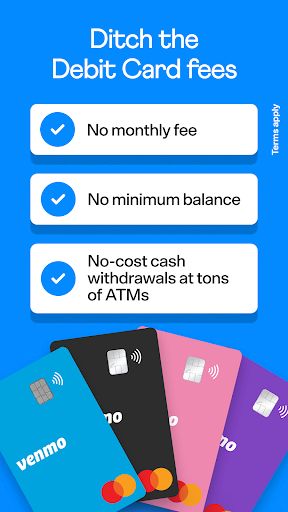

- No cost for sending money using a Venmo balance, debit card, or bank account.

- Intuitive design and user-friendly interface make it easy to navigate and use.

- Social aspect adds an enjoyable dimension to mundane financial transactions.

- Widely accepted among younger demographics, making it a go-to app for shared expenses.

Cons

- Transfers to banks may take up to 1-3 days unless you pay for an instant transfer.

- Credit card transactions incur a standard 3% fee.

- Privacy concerns with transaction history being public by default, though this can be changed in settings.

- Not as widely accepted by merchants as some other payment platforms.

Venmo stands out as a digital wallet app that effectively blends financial transactions with social interaction. While the app is a favorite for many due to its ease of use and engaging experience, users should be aware of the potential fees associated with certain transactions and the importance of managing privacy settings to ensure a secure experience.