Afterpay - Buy Now Pay Later

Afterpay - Buy Now Pay Later Review

The Afterpay - Buy Now Pay Later service has revolutionized the shopping experience by allowing consumers to purchase items and pay for them over time without the immediate financial burden. This interest-free installment plan has been embraced by shoppers looking for a more flexible approach to managing their spending.

What are the purposes of using the Afterpay - Buy Now Pay Later

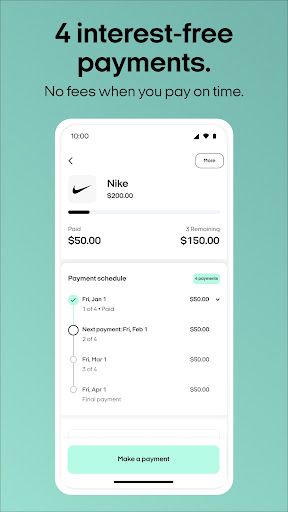

Afterpay serves as a financial tool that enables customers to make purchases instantly and spread the cost over four equal payments. The first payment is made at the time of purchase, followed by three subsequent payments due every two weeks. This service is designed to offer a budget-friendly alternative to traditional credit, without the associated interest charges as long as payments are made on time.

What does the Afterpay - Buy Now Pay Later app provide?

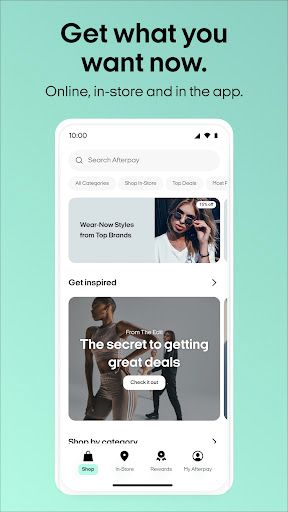

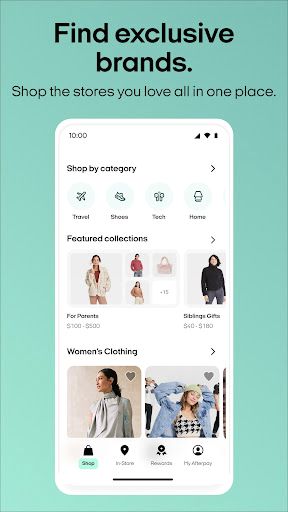

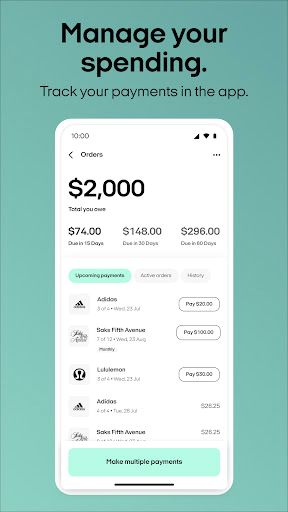

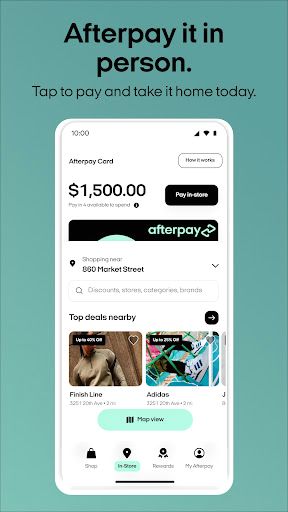

The app offers a seamless and user-friendly interface where consumers can sign up and get an immediate spending decision. Users can shop within the app at a variety of retailers, manage their payment schedules, and check their spending limits. The Afterpay app also sends reminders to help customers keep track of due payments, ensuring they can manage their installments effectively.

Benefits & Features

- Interest-free payments spread across four installments.

- Wide acceptance at numerous online and brick-and-mortar retailers.

- Immediate use upon signing up with a quick approval process.

- Transparent fees structure with no hidden costs.

- Automatic payment reminders to avoid late fees.

- Easy-to-use mobile app with real-time balance and schedule tracking.

- Option to reschedule a payment (once per order) for greater flexibility.

Afterpay offers a convenient and budget-friendly way to shop, providing consumers with the ability to manage their cash flow better. By breaking down purchases into smaller, more manageable installments, it ensures that users can enjoy their products without the stress of a large upfront payment.

Pros

- Encourages responsible spending with no interest fees.

- Enhances purchasing power for consumers.

- Intuitive app design makes managing finances straightforward.

- Immediate access to credit upon approval.

- Helpful payment reminders to keep users on track.

Cons

- Late fees can accumulate if payments are missed.

- Can lead to impulse buying due to the ease of transaction.

- Spending limits may be lower for new users.

- Not all retailers accept Afterpay, limiting shopping options.

The Afterpay service is a testament to the evolving landscape of consumer finance, offering a blend of convenience and control over personal budgets. While users should be mindful of the temptation to overspend, Afterpay's clear repayment structure and user-friendly app make it a valuable tool for those who prefer to stagger their payments without incurring traditional credit costs.